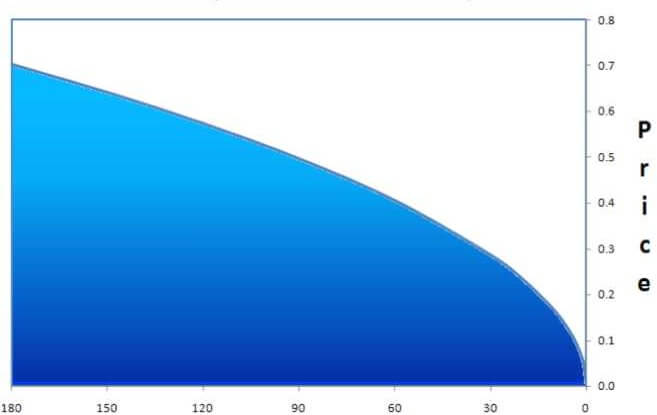

The old adage that time is money holds particularly true when trading options. That’s why it’s very important to understand how theta works, and the affect it has on an option price. Theta is the Greek letter used to represent the impact of time on an option’s value. All options lose value, as they get closer to expiration. However, the rate at which an option contract loses value is primarily a function of how much time remains until expiration. Options tend to lose the most value in the final 30 days before expiration. At that point, the price decay accelerates.

Only the extrinsic portion of an option’s value is subject to time decay. An in-the-money option will retain at least its intrinsic value until expiration. In other words, if an underlying stock is trading at $33, the 30 calls will always have at least $3 of intrinsic value whether there are 3 or 300 days remaining until expiration. Any value above $3 will be extrinsic value and therefore subject to time decay.

Theta, or time decay, is usually expressed as a negative number to represent the loss of value as time passes. Since the time remaining on an option can never increase, time decay is a one-way street. Thus, if the theta is given as -.28, they option contract will lose $0.28 per day in value.

However, it is important to note that theta changes over time. Assuming the price of the stock doesn’t change, an out-of-the-money $2.75 option with a theta of -.15 will be worth $2.60 tomorrow. At that point, the theta may only be -.12. If so, the option will only be worth $2.48 the following day if prices remain constant. Gradually, the value of the option will approach zero as long as it remains out-of-the-money.

It’s also important to note that theta will become a larger percentage of your contract price as it nears expiration. Therefore, in the last few days before expiration, time decay really accelerates (as seen in the chart above).

What an Options Trader Needs to Know

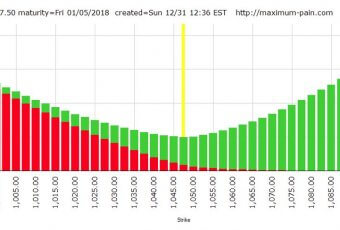

At-the-money options have the highest extrinsic value. For this reason, these options also have the highest thetas. Deep in- and out-of-the-money options have lower thetas because they have less extrinsic value than at-the-money options. The less value they have, they less they can lose through decay.

The only way to have a positive theta position is to be short options. This makes sense when you consider that short option positions tend to do best in stable markets. Wide swings up or down will hurt these positions. Only the passage of time will help. Neutral strategies like the long butterfly also benefit from the passage of time. The less time to expiration, the less chance the underlying stock has to move up or down into unprofitable territory.

Every option position represents a trade off between time and market movement. You can’t benefit from both. If the passage of time helps a position, price movement will hurt it and vice versa. In Greek terms, price movement, the flip side of theta, is known as gamma. Any position that has a positive theta (i.e. a position that benefits from the passage of time) will by definition have a negative gamma. Similarly, a negative theta position (i.e. one that is hurt by the passage of time) will have a positive gamma.