The number one reason why most options traders fail is they rely solely on market timing for success. If you’re using options simply as a leveraging tool to make more money on the predicted movement in a stock or index, you’ll have many trades go in your favor and from time to time you’ll experience fantastic gains. However, if you’re simply buying calls or puts based on what you expect the underlying stock to do, your odds of long term success as an options trader are very limited.

There are two main reasons why this options trading strategy is unlikely to make you money over a long period of time. First of all, accurately picking tops and bottoms is difficult at best, especially to do it on a consistent basis. Second, and more importantly, the movement of an option, and its underlying stock, aren’t always proportional. In other words, you can be correct on the direction of the stock, and yet not make much money. In some cases, you will even lose money on your options.

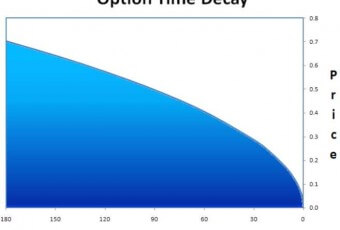

Those who lose money, even when they were correct on the direction of the stock, do so because they don’t understand how implied volatility and time decay affect the price of options. Time decay is easy to understand. Your option expires on a finite date. Each day that passes, the option loses some of its extrinsic value that’s related to time. So, if you’re right on the direction of movement, but the movement is slight, and over a long period of time, you may lose money on that trade.

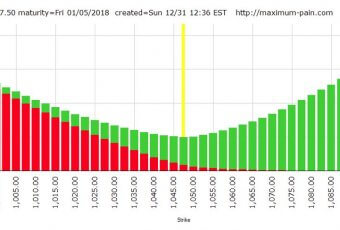

Understanding implied volatility is a bit more complex, and a lot more critical to your ability to make money as an options trader. The main thing to remember is other that buying an option and then having the implied volatility drop will harm the price of your option. To learn more about implied volatility and how it affects the value of options contracts, click here.