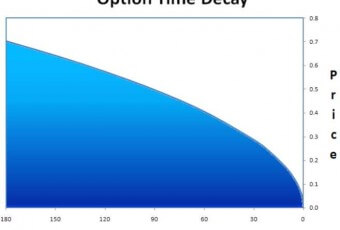

Have you ever bought an option, had the underlying security move the direction you hoped, and still lost money on the trade? If so, chances are you owned an option contract that saw a drop in its implied volatility. Implied volatility is an important component in the price of an option, and understanding how it affects the price of a contract can make the difference between making and losing money on a trade.

Implied volatility represents the expected volatility of a security over the life of an option. As expectations change, option prices will also change accordingly. Implied volatility is affected by the supply and demand of the particular contracts, and by the market’s expectation of potential price movement. As expectations rise, or as the demand for an option rises, implied volatility will also rise.

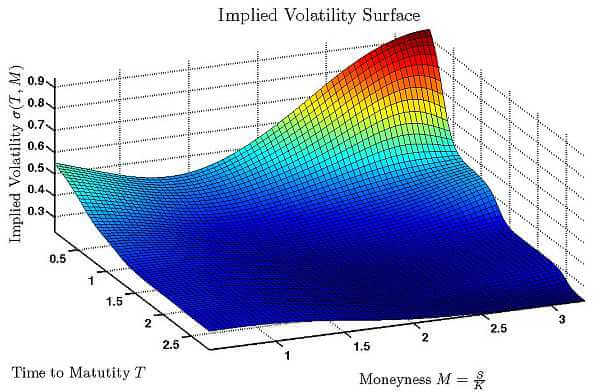

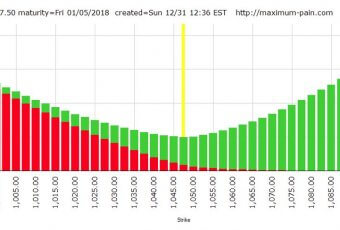

Knowing the current implied volatility of an option, and its likelihood to either rise or fall, will greatly increase your odds of successful options trading. Much like stocks, the idea for implied volatility is to buy low and sell high. If you are going to take a net long position in an option, such as buying puts or call, you want to buy when implied volatility is likely to increase. If the implied volatility is unusually high, and likely to decline, you’ll want to be a net seller of the contracts. It’s also important to note that implied volatility isn’t the same for all contracts on a given security. Each strike price and expiration will have its own implied volatility.

Even though implied volatility can change quite often and vary from contract to contract, there are a few rules of thumb you can follow. In general, implied volatility will rise prior to an earnings report, or some other news item, and then fall immediately after. Options with strike prices near the money will have larger swings in implied volatility than those who are farther into, or out of, the money. Front month contracts with little time until expiration will see less implied volatility changes than contracts with a longer time until they expire. Finally, implied volatility will run in cyclical trends, so much can be learned from looking at a security’s volatility chart and comparing its current level to historical levels.

Taking the time to research an option’s implied volatility is just as important as researching the direction of the underlying security. An understanding of how to use implied volatility is one of the big differences between professional traders and speculators.