This article was originally published on the Foundation for Economic Education’s website, FEE.org and was written by Kurt W. Rotthoff, who is a Professor of Economics and Finance at Seton Hall University’s Stillman School of Business. The original article can be found here.

I like to ask my class what it takes to be wealthy, and someone always says, “one million dollars.” I typically respond by saying, “well, that is true for a lot of people, but one million dollars is easy – I’m going to show you how to have much more than that!”

On FEE’s website, David Veksler has an article: How to Become a Millionaire by 40. In the article, Veksler states, “By my estimate, a majority of American households would be worth a million dollars by their 40s if they start early and make a concerted effort.”

He is right. And I think the math to make this work is easy, in fact, I think we should walk through it here (and you are welcome to put in your own numbers too). But before we walk through it all, I want to give you the equation I learned in high school (thanks to my favorite teacher, Mrs. I) that makes this all work.

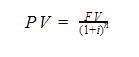

It is called the Present Value formula:

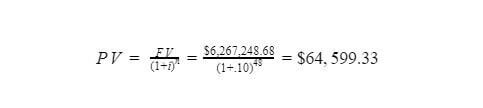

Where PV is the Present Value, FV is the Future Value, i is the interest rate, and n is the number of years. This equation allows you to figure out how much your money is worth in the future (if you have a certain amount now) or how much you need now to get to a certain amount in the future. So, let’s walk through that math here.

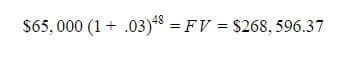

Let’s set up an example where you graduate from college at 22 years old, and you have a starting salary of $65,000. Then assume you work until you are 70, meaning you have to work for the next 48 years (tip: this is why you should pick a job you like). Also, assume they receive 3 percent raises per year (which is approximately the national average in the United States). Thus, in your last year of work, you will be making $268,596.37. Filling in the equation above (with the cross-multiplication) is:

Now that you have hit your retirement, what you need to figure out is how much you need to retire comfortably. This is contingent on your life expectancy, which is very difficult to predict – but one strategy is to set up a personal endowment (money that will last forever because you only live on the interest earned – which means you cannot outlive your money).

Now that you have hit your retirement, what you need to figure out is how much you need to retire comfortably. This is contingent on your life expectancy, which is very difficult to predict – but one strategy is to set up a personal endowment (money that will last forever because you only live on the interest earned – which means you cannot outlive your money).

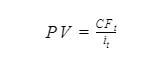

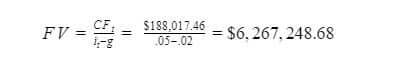

To do this, we first want to think about how much money we need each year in our retirement. Financial planners say to expect your expenses to fall to 60-80 percent of your pre-retirement expenses (less commuting, you can now travel during off-peak times, etc.). Thus, let’s assume you need 70 percent of your pre-retirement income. Which means you need $188,017.46 (.7 times the $268,596.37). But remember, you need this per year, and every year, throughout your retirement. So what you need is this money as what’s called a Cash Flow. To solve for a cash flow, you need to use this equation (where PV is still the present value, CF is the cash flow needed each year, and i is the interest rate):

But you have to take into account inflation, the fact that prices rise over time. Thus you need to adjust each year’s cash flow by a growth rate so that you can still buy the same amount each year (i.e., you need more money each year to account for the fact that items cost more). So you need to attach a g, or growth rate, to this equation. In the U.S. the average inflation rate is about 3.1 percent per year, but this has a real impact on consumers of 2 percent per year (due to the fact that people shift their consumption as prices rise). Thus (here the i used is the nominal return on a safe investment, U.S. Savings Bonds—which have a long-term average return of 5%):

Wow, that is a lot of money! Not only do you need more than $1 Million, but you need $6.2 Million! That is a lot of money. But there is good news here: if you’re young, you have a lot of time until you need this money (this is why Veksler recommended people begin saving for retirement at an early age).

Although most of the personal-finance literature will argue that you should save a certain percentage of your income every year throughout your whole life, I am making a different recommendation: if you can save as much as possible your first-year out of college (or first two- or three-years out of college), how much would you have to save? Remember that present value formula?

The 10 percent comes from the historical average returns to the stock market (simply buying a low-cost total market fund), which means that if you saved $64,599.33 in your first year of work you would never have to save again! (note: it is not that much per year – it is that much one time, or that amount split between the first few years).

I assumed that during your working years you would take the risks of investing in the stock market and you would take the safer option in retirement (when in all likelihood you would mix those in both of those time periods), but the simplicity allows us to think about how important the “start early” statement really is.

What I tell my students is, “keep living like a college kid for a year or two after graduation and save everything you can.” And if you do this, you will set yourself up for a well-endowed retirement. I know you do not want to think about this the first year you start work, but the value of endowing your entire retirement is worth it. Although I am not retired yet, I did this – and it works!

About the Author

Kurt W. Rotthoff is a Professor of Economics and Finance at Seton Hall University’s Stillman School of Business. His research interests include applied microeconomics, financial economics, and industrial organization, with a focus on the application of economics and finance to the sports industry and the economics of education. He holds a B.S. from Westminster College (PA), and an M.A. and Ph.D. from Clemson University (SC). Dr. Rotthoff has had papers published in Applied Economics, Applied Economics Letters, Applied Financial Economics, Economic Inquiry, Economics Letters, Economics of Education Review, International Journal of Sports Finance, Journal of Economic Behavior and Organization, Journal of Economics and Finance, Journal of Sports Analytics, Journal of Sports Economics, Journal of Quantitative Analysis in Sports, and the Southern Economic Journal (along with others).

Suggested Further Reading:

“Retirement Planning Guidebook: Navigating the Important Decisions for Retirement Success” – by Wade Pfau

This is the Revised 2024 Book Edition published in January 2024 The Retirement Planning Guidebook helps you navigate through the important decisions to prepare for your best retirement. You will have the detailed knowledge and understanding to make smart retirement decisions.

Available on Amazon