Long gone are the days when only institutional traders used options contracts in their investment portfolios. Today, you’ll find them being traded in many, if not most, retail trading accounts, too. Aside from their value as a hedge or income producing tool, many small traders love the fact that there’s an opportunity to create high percentage returns in a short period of time…all the while, having little capital at risk.

However, one drawback for many retail options traders is that a lot of the most actively traded stocks, such as Google, Apple, Amazon, and others, have options with premium prices so high that it makes trading even one contract a little risky for the small investor. For instance, depending upon the level of the VIX, it can cost around $4,000 to buy one at-the-money call contract that only has a couple of months until expiration…a heavy duty risk for somebody who’s working with a portfolio of $100,000 or less.

Cheaper Options

As a way to make options on these popular stocks more accessible to the average trader (and no doubt create more trading volume on the exchanges) NYSE Euronext started offering mini options contracts. On March 18th, 2013, trading began for mini contracts in the three aforementioned stocks, as well as the Gold (GLD) and the S&P 500 (SPY) Spiders.

These mini contracts are for the delivery of 10 shares of stock, rather than the 100 shares covered by the traditional contracts. If a smaller retail investor now wants to take an options position in one of these stocks, the capital at risk can be 1/10th of what it was before. Having $400 at risk on a Google call contract is a lot more palatable and accessible than $4,000. This also makes it possible to hedge an odd lot position at a reasonable premium.

Are They Right for You?

The question is, are mini options contracts right for you? The answer, as far as we’re concerned, is maybe. If you were already involved in options trading, but getting involved with contracts in GOOG, AMZN, or AAPL were too rich for your blood, this is a great opportunity. If you have an odd lot position of 30 or 40 shares of these stocks and you’d like to hedge your position or sell a covered call, once again, this is a great opportunity.

However, if you weren’t involved in options trading before, but you’re sure you know Apple stock is about to make a huge run up, don’t use mini contracts as an excuse to get into a trading arena you weren’t in before.

Bottom Line

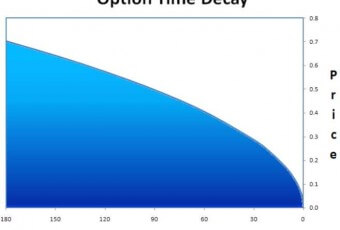

Yes, there’s less money at risk with a mini…but they’re still options, and they can still burn you. A baby rattlesnake may look less intimidating than momma, but make no mistake about it, their venom can still kill you.

As always, understand all the risks and mechanics of options trading before getting involved, and make sure you manage your position sizes. For more specifics on available min contracts, visit the CBOE.