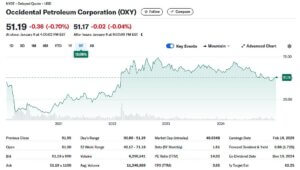

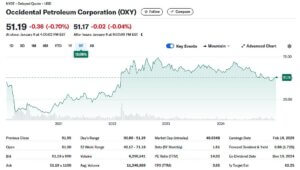

Occidental Petroleum Corporation (NYSE: OXY) has been a significant player in the energy sector, blending traditional oil and gas operations with forward-thinking sustainability efforts. As we move through 2025, let’s explore why OXY might be a compelling addition to your investment portfolio.

Energy Sector Dynamics

- Global Energy Demand: Despite the rise of renewables, oil and gas remain central to global energy consumption. In 2025, increasing industrial activities and economic growth are expected to drive oil demand to new heights. Occidental’s substantial involvement in oil and gas positions it to benefit from this sustained demand.

- Inflation Hedge: Energy stocks often serve as a buffer against inflation. As commodity prices rise, companies like Occidental can experience enhanced revenues, providing a safeguard for investors concerned about inflationary pressures.

Financial Resilience

Financial Resilience

- Robust Cash Flow: Occidental has demonstrated strong cash flow generation, enabling it to manage debt effectively, invest in growth opportunities, and return value to shareholders. This financial strength underscores its operational efficiency and strategic planning.

- Debt Reduction: Following its acquisition of Anadarko Petroleum, Occidental prioritized reducing its debt. Significant progress has been made, enhancing the company’s financial stability and reducing risk for investors.

- Shareholder Returns: The company has been committed to rewarding shareholders through dividends and share buybacks. A consistent dividend yield and strategic repurchase programs reflect management’s confidence in Occidental’s long-term prospects.

Strategic Growth and Sustainability

- Carbon Capture Leadership: Occidental is at the forefront of carbon capture and storage (CCS) technology. Its subsidiary, 1PointFive, is developing direct air capture facilities aimed at reducing atmospheric CO2. This commitment not only addresses environmental concerns but also positions the company as a leader in sustainable energy solutions.

- Efficient Operations: Operating in resource-rich areas like the Permian Basin, Occidental maintains low cost production. This efficiency allows the company to remain profitable even when oil prices fluctuate, highlighting its competitive advantage in the industry.

Valuation and Market Perception

- Attractive Valuation: Occidental’s current trading metrics suggest it is undervalued compared to industry peers. This presents a potential opportunity for investors seeking value in the energy sector.

- Institutional Confidence: Notably, Berkshire Hathaway, led by Warren Buffett, holds a significant stake in Occidental, owning approximately 28% of the company. This substantial investment reflects confidence in Occidental’s business model and future performance.

Considerations and Risks

- Commodity Price Volatility: Fluctuations in oil and gas prices can impact profitability. However, Occidental’s diversified operations and cost management strategies help mitigate this risk.

- Regulatory Environment: The energy sector faces evolving regulations, especially concerning environmental impact. Occidental’s proactive approach to sustainability through CCS initiatives positions it favorably to navigate these challenges.

- Economic Uncertainty: Global economic shifts can influence energy demand. Occidental’s strong financial footing and operational flexibility equip it to adapt to changing economic conditions.

Conclusion

Occidental Petroleum presents a balanced investment opportunity, combining traditional energy production with innovative sustainability efforts. Its financial health, strategic initiatives, and market positioning make it a noteworthy consideration for investors in 2025.

As always, it’s essential to conduct thorough research and consider your investment goals and risk tolerance when making investment decisions.

Here are some other stocks we also like for 2025:

- Robinhood Markets, Inc. (HOOD)

- Alibaba (BABA)

- Palantir Technologies (PLTR)

- Hims & Hers Health (HIMS)

- ASML Holding N.V. (ASML)

- PayPal (PYPL)