Think you can peg a stock’s price at expiration and want to catch a profit? Try a butterfly – its bite can be gentler than with other strategies. The Butterfly is an option position that is composed of 2 vertical spreads that have a common strike price. In other words, butterfly trading involves an opening position where options (either calls or puts) are bought (or sold) at 3 different strike prices. The way in which these options are created makes the butterfly a position that has both limited losses and limited profits, and is considered a neutral market trading strategy.

The Long Butterfly can be created using either all call options or all put options. Due to put-call parity, a long butterfly created using call options will behave like a long butterfly created using put options. In other words, it doesn’t really matter whether you use calls or puts to create your long butterfly. Our example here will focus on the version using call options.

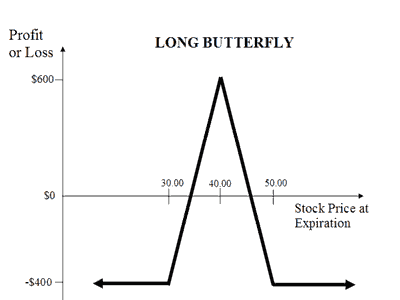

Using the graph above as the example, we will be buying an In-the-Money (ITM) call option at $30, selling 2 At-the-Money (ATM) call options at $40, and buying another Out-of-the-Money (OTM) call option at $50 to create the long butterfly. This is actually a combination of 2 opposing vertical spread options, hence why the butterfly is also known as the butterfly spread.

Combining the profit profile of these 4 call options, you will find that if the stock price falls, you will face limited losses (which is the initial premium you paid for the entire butterfly trade). Similarly, if the stock price climbs too high, you will also face limited losses. However, if the stock price stays around the vicinity of the ATM option strike price, you will receive limited profit.

This makes the long butterfly a good neutral option strategy for low volatility, since you are betting on the stock price not moving much in order to collect maximum profits. It is also a low-risk strategy, since your losses are limited if the stock crashes or climbs unexpectedly. Unfortunately, this is accompanied by limited profits as well. As has been mentioned above, the long butterfly can also be created using all put options instead of all call options.

A Short Butterfly is the exact opposite of the long butterfly. Instead of buying an ITM call, selling 2 ATM calls and buying an OTM call, a short butterfly is constructed by selling an ITM call, buying 2 ATM calls and selling an OTM call. As before, the short butterfly can be created using all put options instead of all call options.

The short butterfly’s profit profile is the opposite of the long butterfly’s. If the stock price falls, you will receive your maximum limited profits (which is the initial credit premium you received when opening the short butterfly position). Similarly, when the stock price climbs, you will also receive limited profit. However, if the stock price doesn’t change much, you will face a loss, though that loss is limited as well.

As you can see from the above description, the short butterfly is meant to be a strategy that is high in volatility but neutral in direction (i.e. you expect the stock to move a lot, but do not know in which direction). As a side note, this might not be the best strategy for you if you are indeed expecting high volatility and are uncertain in stock price direction. Both the Straddle and the Strangle strategies also have the same lean towards high volatility and neutral direction, but with the extra benefit that they have the potential for unlimited profit. However, the benefit of the short butterfly is that it is a credit position where you pocket the initial premium when creating it.

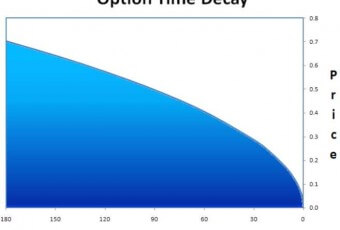

*One warning about both long and short butterfly trading: These positions involve buying and selling options at 3 strike prices. For most option brokers, this means you will be paying 3 commissions to open the position, and another 3 commissions to close it. You will need to consider these extra commissions (which differ from broker to broker) when trying to determine if the butterfly will be profitable for your circumstances. If you choose to do this type of trading, we highly recommend using a broker that offers special pricing on spread trades, rather than charging you for each leg.