Buying call options is the most basic of options trading strategies, and the way that most options traders get started. The concept is pretty simple. You find a stock that you believe is going to appreciate in value over the near term. You want to take advantage of this, but instead of just buying the stock, you’d like to use the leverage power of options to create a higher percentage gain on your investment.

How to Get Started

The first thing you need to do is open an options trading account. If you already have an account open with a broker, all you need to do is ask them to approve you for options trading. They’ll require you to fill out a suitability questionnaire prior to approval, but almost everybody gets approved for the first level of options trading, which allows you to buy calls and puts or write covered calls. If you intend to make options trading a regular part of your trading strategy, we recommend opening an account with a brokerage firm that specializes in options trading.

Important Aspects of Call Options

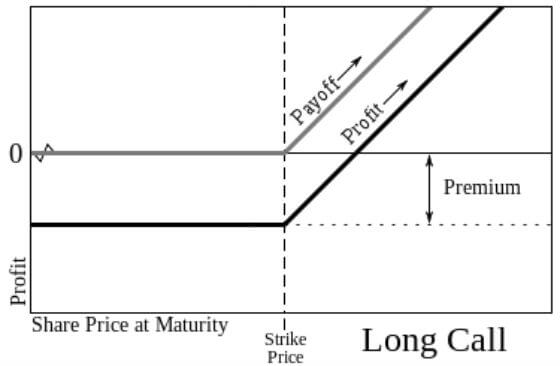

Buying a call option gives you the right, but not the obligation, to buy somebody else’s shares of stock at an agreed price (strike price), by an agreed time (exercise date). The important part of the last sentence is “not the obligation”. The vast majority of options contracts are not exercised. They are bought with the intention of selling them for a profit.

Each call contract that you buy covers 100 shares of the underlying stock. This is where the leverage comes from. If you buy 1 call contract on a stock that is trading in the market at $60, you are controlling $6,000 worth of stock. Depending upon the strike price and exercise date, that call option might be trading for only $2. That means for a $200 investment ($2 x 100 shares controlled by the contract) you can make profits on $6,000 worth of stock.

Choosing the Right Call Contract

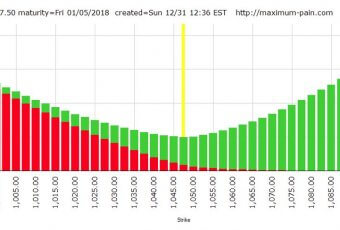

Once you’ve done your research and isolated on a stock that you believe is going to move higher in the market by a certain date, it’s time to choose your option contract. Each stock has an array of call options (the option chain). The chain will have many different contracts with various strike prices (the price you would pay for the underlying stock, if you chose to exercise your option) and expiration dates (the end of the life of the contract).

In the option chain there will be contracts that are out-of-the money, which for call options means the stock is currently trading below the strike price, at-the-money contracts (strike price and share price are nearly the same) and in-the-money contracts (stock is trading above the strike price). Buying out-of-the money calls will give you more leverage because the price of the options will be lower, however these contracts also carry more risk. In-the-money calls will give you less leverage and a lower percentage return, however they will also give you a higher probability of having a successful trade. In other words, they’re more conservative.

Since buying calls is an aggressive strategy, we recommend buying in-the-money calls whenever possible. If you can’t afford to buy in-the-money contracts, we recommend you buy at-the-money calls. The higher risk of out-of-the-money contracts makes it easier to lose money. One of the keys to being successful as an options trader is to understand that you’re not going to be right all the time. You will have losing trades, but if you don’t let them empty your account, you can come back and trade another day.

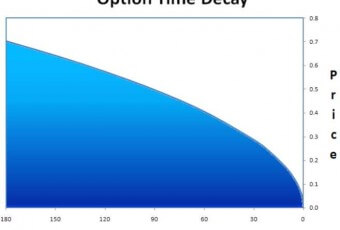

The other decision you need to make is which exercise date to choose. The longer amount of time you have until expiration, the more your calls will cost. However, having more time until expiration also increases your probability of a successful trade. Aside from the obvious fact that it gives the stock more time to move higher in the market, options prices erode over time. The effect of this price erosion is less pronounced the farther you are from the expiration date.

This is obviously just a basic introduction to buying calls, and options trading in general. Options trading is a very complex method of trading with many nuances. In order to be a successful trader, we recommend you study much more about how options are priced, and what influences their price movements. It’s not as simple as picking a stock that will go up and profiting from it.